© Provider: Zive.cz

The government's amendment to the VAT law, which follows the new EU customs regulations in place since the start of the summer holidays, has stalled in the Senate, which was not due to consider it until July 22, but it seems some big Asian e-shops have been already prepared in advance and of course independently of the situation in the periphery of the Czech Republic.

The end of cheap trinkets from AliExpress: how we shop from abroad during the summer holidays

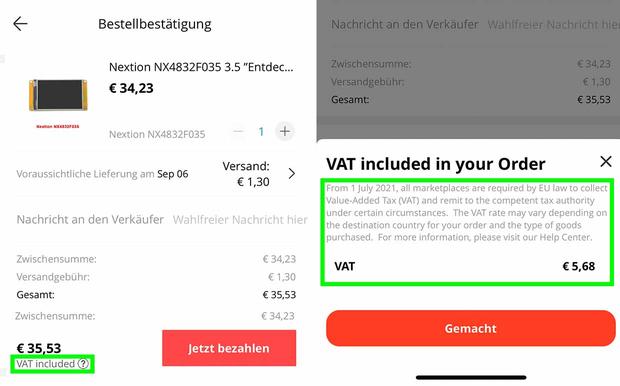

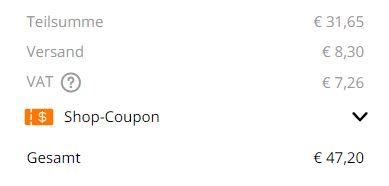

This is especially true for AliExpress, which orders VAT (Value Added Tax) already in the payment overview when ordering to a European address, which increases the price of the goods accordingly.AliExpress justifies this step by changing the current policy in EU countries where the cheapest shipments were exempt from VAT. China's AliExpress has tax partners in the EU and pays VAT through them.

If AliExpress does not pay the VAT for us, we would have to do it ourselves after the package arrived in the Czech Republic via the eCEP portal by filling out an electronic customs declaration for shipments up to 150 euros, or via a logistic partner - typically the Czech Post .However, it charges a relatively high fee for this service.

Example with shoelaces

I looked for red shoelaces on AliExpress, which the integrated currency converter valued at 18.2 crowns. In the detailed overview before the actual payment, however, I see VAT of 4.88 crowns. Together with the postage of 5.55 crowns, the Total amount eventually rise to 28.63 crowns.

The VAT position is calculated from the sum of the price of goods and postage - in this case from the amount of 23.75 crowns. The 4.88 crowns also correspond to the Czech 21% after rounding.

Example with remote control

Let's look at another example. This time I want to buy a cable release for DSLR. It costs 289.64 kronor after the changeover and the postage is free this time. So the VAT is calculated only from the value of the goods and AliExpress has it with 60, 81 kronor is calculated, which after rounding is 21% again. The total price will therefore jump to 350.45 kronor.

Will the driver arrive without additional formalities and fees?Enough theory - I just bought it and as soon as it arrives, practice will show everything.Then, of course, I'll update the article.

Did you go through this wheel? Did the yellow or gray envelope arrive the same as before? Share it with us and readers in the discussion below the article.

Also read:

Apple created the WWDC. He showed a bunch of news at the keynote

Three tips for picking up a WiFi signal at home and in the office

Bluetooth was born 32 years ago. Do you know the meaning of its mysterious logo?

See more